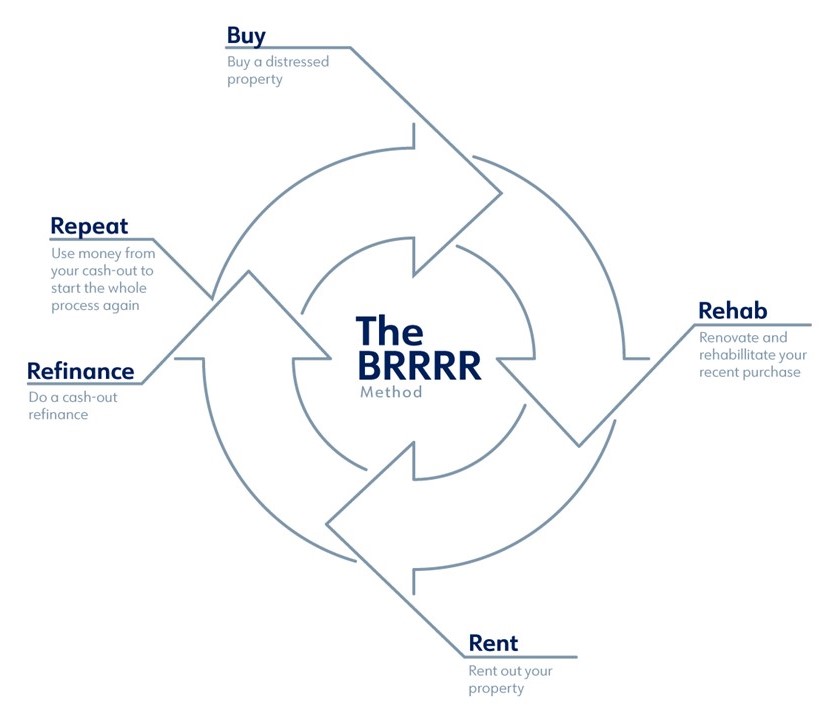

BRRRR strategy can provide passive income and a revolving method for purchasing and owning rental property. The method works through the following steps: Buy a property: The property you purchase should be a distressed property that needs some work to get […]

read more

Investor Loans

Why Consider A 1031 Tax Exchange?

When you are selling an investment property can be subject to taxation. Those taxes can add up quickly depending on the type of property, how long it was owned, state taxes, capital gains, depreciation and the owner’s tax bracket. As […]

read more

read more

5 Things You Should Know Before Investing in a Turnkey Property

What is Turnkey Investing? At its core, turnkey real estate investing is where you buy already rehabbed, tenant-filled, managed properties that are producing positive cash flow. A lot of the extra work that goes into real estate investing is cut […]

read more

read more

Home flips continue to grow, but profit margins continue to slide

Home-flipping activity and home-flipping profits went in two squarely different directions during first-quarter 2022, according to the most recent U.S. Home Flipping Report from Attom Data Solutions. According to the real estate analytics company, 114,706 single-family homes and condominiums were […]

read more

read more

Should You Lock Your Interest Rate Today IF You Are Building An Investment Property?

Highlands’ 1 Year Rate Lock Extended Program! Highlands Residential Mortgage is excited to share our newest way to help buyers in new construction. Our Extended Rate Cap Program will guarantee and protect your client’s interest rate for up to 360 […]

read more

read more

Specialty Programs for Investors

HRM INVESTOR REHABILITION LOAN PROGRAM Program highlights include: 20% down payment No Limit on repair amounts Fees for up 5 draws are included Single-Family Homes 30 & 15 year fixed mortgage No prepayment penalty The cost consultant fee may be […]

read more

read more